Astra G2 Accounting Year End

PURPOSE

To help clients understand the process of Accounting Year End in Astra G2.

Astra Product

G2.

Process

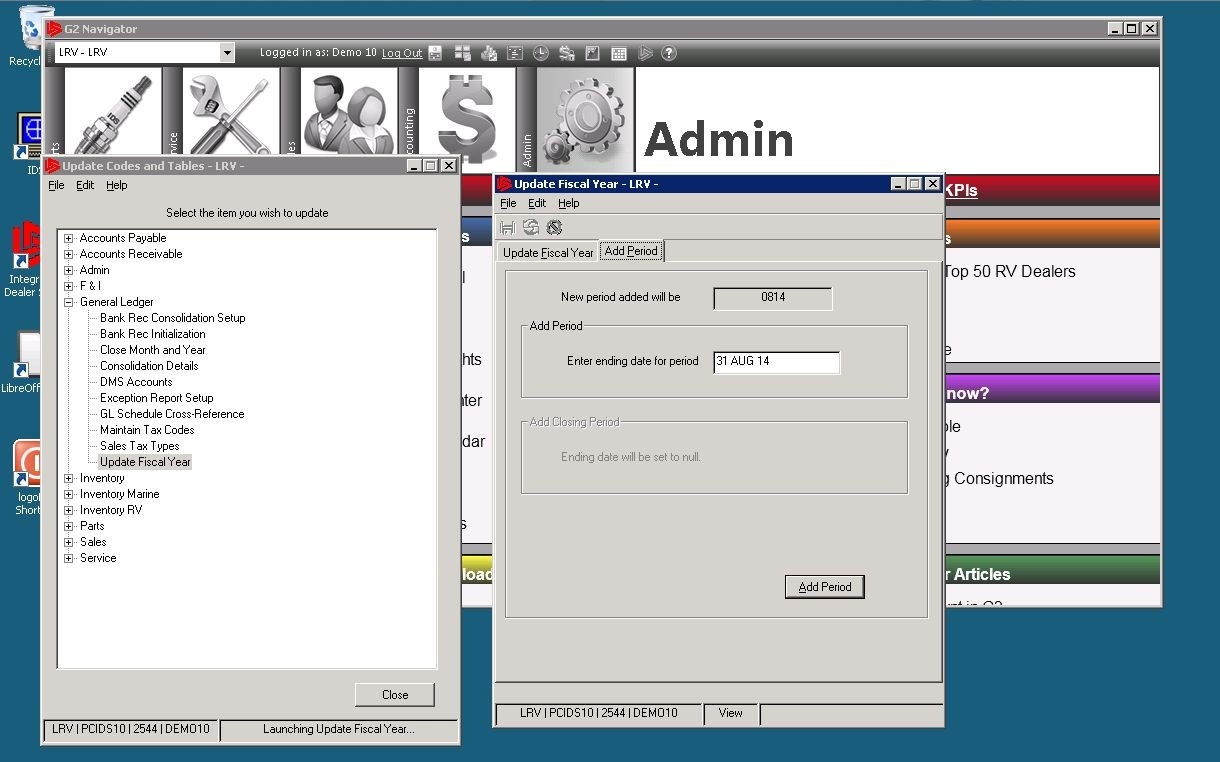

The first item to keep in mind is that if period 12 is not closed separately, the period 12 month-end routine will be completed during the year-end process. The second step will be to add as many periods to the Control Record as needed to complete the year end verification. This can be done by going to Admin – Setup – Update Codes and Tables – General Ledger – Update Fiscal Year – Add Period. This will enable everyone to continue working in the next period without closing the year.

*If additional periods are not added, invalid transactions with a period of XXYY will result. Any transactions with a posting error should be reported to the Support Department as soon as possible.

The next step will be to verify that all protected account information is correct.

Make sure all payables, receivables, payments, checks, inventory, floorplan, deals, work orders, and payrolls have been entered and posted in period 12 as needed.

Also verify that all bank deposits have been updated and the bank reconciliations have been done. Process all sales tax. Record all adjusting journal entries. Remember that only journal entries to non-protected accounts can be made to that year once it is closed.

Reconcile the Big 4 (AP, AR, Inventory, and Floorplan) to the Balance Sheet.

Verify that all necessary general ledger accounts exist (Accounting – General Ledger – Maintain the General Ledger) A general ledger account cannot be added for a year once the year is closed. Make sure all adjustment accounts for journal entries are in place before closing the year.

Compare the Parts Value to GL Value. Reconcile the Parts Value Report (Parts – Parts Reports – Run Parts Reports – Print Parts Value Report) and the Work in Process Report (Service – Service Reports – Run Service Reports – List Open W/O-Costs & Prices) to the general ledger balance after the parts year-end routines have been performed.

Next, move Parts Sales History (Parts – Utilities – Conduct a Parts Count – Functions – Move Parts Sale History)

*This routine is mandatory and MUST only be completed on the last day of the fiscal year end (not the last day of the calendar year unless they are one and the same). This routine moves the parts sales history from the current year to the previous year as displayed in Parts – Parts Maintenance – Maintain Parts – Parts Sales.

Once the parts sales history has been moved, Post transactions (Accounting – General Ledger – Post GL Transactions)

- Review the Balance Sheet (Accounting – Accounting Reports – Run General Ledger Reports – Balance Sheet)Review the Service Labor Payable account to verify that the service technician payroll is posting correctly.

- Review the Salaries/Wages/Commissions account to verify that the salesman payroll is posting correctly.

- Review the Sublet Payable account to verify that the sublet work is being billed correctly.

- Review the Deferred Parts Liability account to verify that the parts and purchase orders are being received into inventory correctly.

- Review the License Payable account to verify that the license fees are being paid correctly.

- Verify that all accounts have reasonable balances.

The last step before closing the fiscal year is Review the P&L (Accounting – Accounting Reports – Run General Ledger Reports – P&L Statement)

Verify that the income and expense accounts look reasonable. Review any accounts that have an incorrect balance (such as an expense account with a credit balance or an income account with a debit balance) to verify correct posting.

CLOSING THE FISCAL YEAR

Notes

- All users should be logged off the system while performing the year-end routine.

- Never break out or turn off the workstation/computer during the year-end routine.

- Although it is not necessary to make an appointment, plan on running the year-end routine while IDS support is available.

- Plan on running the year-end routine on a reliable workstation with a reliable printer.

- Follow the directions given throughout the year end routine.

- Make sure to get a good back up and keep in a safe place. *Do not put the tape back into rotation.

- The following will be completed during the year-end process:

- Validate the general ledger

- Post transactions

- Print trial balance – period 12 **

- Generate closing entries to Retained Earnings

- List transactions created by the routine **

- Post year-end closing entries

- Print closing trial balance – CLO”YR” **

- Move data to history

** These will print only if the selection box to suppress printouts is not selected.

1. YEAR END CLOSE ROUTINE (Admin – Setup – Update Codes and Tables – General Ledger – Close Month and Year – Close Year)

- A message stating that no one should be on the system while this routine is run will be on the screen. Verify that everyone is off the system. In order to suppress printouts to print at a later time, click in that selection box.

- The top of this screen will show the current year (the year that is being closed). Verify that this is the correct year. If the box to suppress printouts is not selected, verify the printer. Click on ‘File’ in the tool bar, click on print setup. The default printer will show on this page. Use the drop down arrow to choose the correct printer. Once everything has been verified, click on ‘Close Year’.

- This routine will then clear and rebuild the sub legers, validate the General Ledger and post transactions.

- The Trial Balance for period 12 will print unless the option to suppress printouts has been selected.

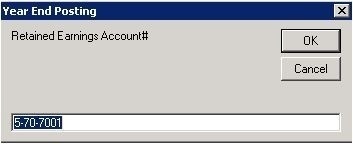

- Verify the Retained Earnings General Ledger account number. The Retained Earnings account will pull in from the standard parameters in 11-5-9 in Astra. If the account is correct, click ‘Ok’ and the closing entries for the income and expense accounts will be created. If the account is not correct, enter the correct account in the field provided. Be sure to change the account in the standard parameters when the year-end routine has been completed.

- A list of the closing entries will be printed unless the option to suppress printouts has been selected and the closing entries will be posted.

- The Trial Balance for the CLO period will be printed unless the option to suppress printouts has been selected.

- The General Ledger for the current year will be moved to a new file.

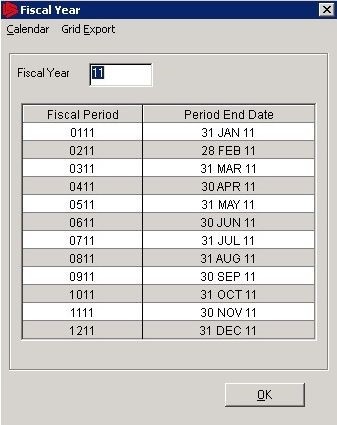

- Verify and enter the new fiscal period end dates. Be sure to have a calendar handy to allow for Leap Year, holidays, and any other office closures that will affect the month or year closings. To do this, click in the field for the period ending dates that need to be entered. Right click in these fields to choose the dates from a calendar or simply type the date into each field.

- Once the fiscal year has been updated, click ‘Ok’ to complete the year end process.

- Click ‘Ok’ at the message that states ‘GL Year End is now completed. Current year is now set to 12 (or whatever the new year currently is)’.

2. JOURNAL ENTRY FOR LAST YEAR (Accounting – General Ledger – Update Journal Entries)

- After the year end routine has been run, the only way to post to the prior year is via a journal entry. In the period field, enter period 12 of the prior year. A message will show stating that it is a ‘Journal Entry to Last Year’.

- For any non-protected account balance corrections, journal entries can be made in this routine. The transaction will post immediately and Retained Earnings will be updated at that time, if necessary.